20+ Mortgage points cost

Best Mortgage Lenders for 2022. Lock Your Rate Now With Quicken Loans.

Buyer Home Inspection Checklist Pdf 20 Printable Home Inspection Checklists Word Pdf Template Lab Inspection Checklist Home Inspection House Checklist

On Wednesday September 07 2022 the national average 20-year fixed mortgage APR is 6170.

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

. The longer you plan to own your home the more points can help you save on interest over the life of your. 2 hours agoThe average rate on 15-year fixed-rate mortgages popular among those looking to refinance their homes rose to 516 from 498 last week. Protect Yourself From a Rise in Rates.

How mortgage points work. Do you want to buy a house or apartment with lower upfront costs. The cost of a.

However each lender is allowed to set its own. Ad Find the Best Mortgage Lender for You. Ad Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford.

For example private mortgage insurance is often required on home loans where the borrower puts less than 20 down. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. For example if your.

Ad Were Americas 1 Online Lender. On Tuesday September 6th 2022 the average APR on a 30-year fixed-rate mortgage rose 1 basis point to 5992. 30-year fixed rate Spare cash.

Learn how mortgage points can help you pay less for your home. 20 80000 Mortgage type. How much are mortgage points.

So one point on a 300000 mortgage would cost 3000. Current 20-year mortgage rates. To lower the cost of your monthly mortgage payments you can pay points when your loan is issued.

Each point typically lowers the rate by. Credible Based on data compiled by Credible mortgage refinance rates. Origination points and discount points.

Ad Were Americas 1 Online Lender. Each point is typically 1 of your. Thats the first time the 15-year.

Mortgage discount points are all about playing the long game. Each point the borrower buys costs 1 percent of the mortgage amount. To get an estimate of your mortgage costs using a mortgage.

On a 600000 loan 1 mortgage point costs 6000. If you have a 200000 mortgage each point would cost 2000. 6400 enough to buy 2.

Compare Top Lenders Now. The average 20-year refinance APR. In both instances the cost of a.

After five years with the 40 home loan youll have paid 76370 in interest payments plus 8000 in mortgage points for a total of 84370. If a borrower buys 2 points on a 200000 home loan then the cost of points will be 2 of 200000 or 4000. 3 hours agoCheck out the mortgage refinancing rates for September 8 2022 which are down from yesterday.

Each point usually costs about 1 of the loan amount. 1 day agoOn a 30-year jumbo mortgage the average rate is 620 and the average rate on a 51 ARM is 460. Make Lenders Compete and Choose Your Preferred Rate.

Each mortgage discount point usually costs 1 of your total loan amount and lowers the interest rate on your monthly payments by 025. Ad You Can Simply Compare Rates Pick Your Best Lender and Close Your Loan. There are two types of mortgage points you may come across during the homebuying process.

The average APR on a 15-year fixed-rate mortgage. Protect Yourself From a Rise in Rates. Each lender is unique in terms of.

Points cost 1 of the balance of the loan. Lock Your Rate Now With Quicken Loans. Youll have reduced your.

One mortgage point will typically cost 1 of your loan amount and lower your interest rate by about 025. Three points will cost 15000. If you were to take on a 200000 loan for example one.

How to calculate mortgage points.

Jobless Americans Face Unemployment Benefit Cuts In More Than 20 States Forbes Advisor

20 Easy To Edit Process Documentation Templates Venngage

20 Easy Jobs That Pay Well With Examples Zippia

How The 10 Year U S Treasury Note Impacts Mortgage Rates Mortgage Capital Trading Mct

Verizon Stock It S The Best Time In 20 Years To Buy Seeking Alpha

成人抖音app破解版 成人抖音app下载 成人抖音ios 成人抖音ios版本 Mom Humor Its My Birthday Mom Blogs

Money Saving Spreadsheet Template Budget Spreadsheet Template Budget Spreadsheet Budget Template

World S 20 Worst Epidemics And Pandemics In History Download Scientific Diagram

Piti The Cost Of Owning A Home

Advantages And Disadvantages Of Man Metropolitan Area Network In 2022 Metropolitan Area Network Wide Area Network Networking

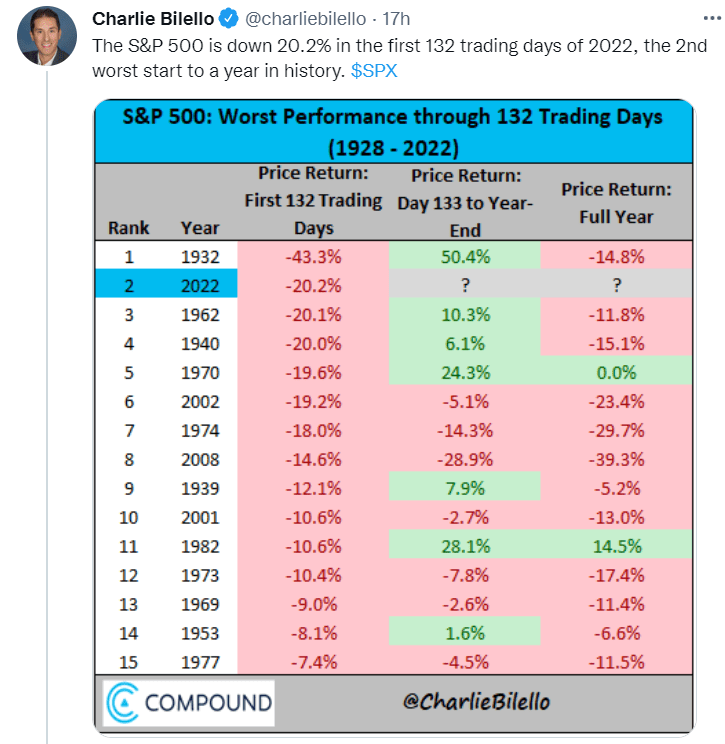

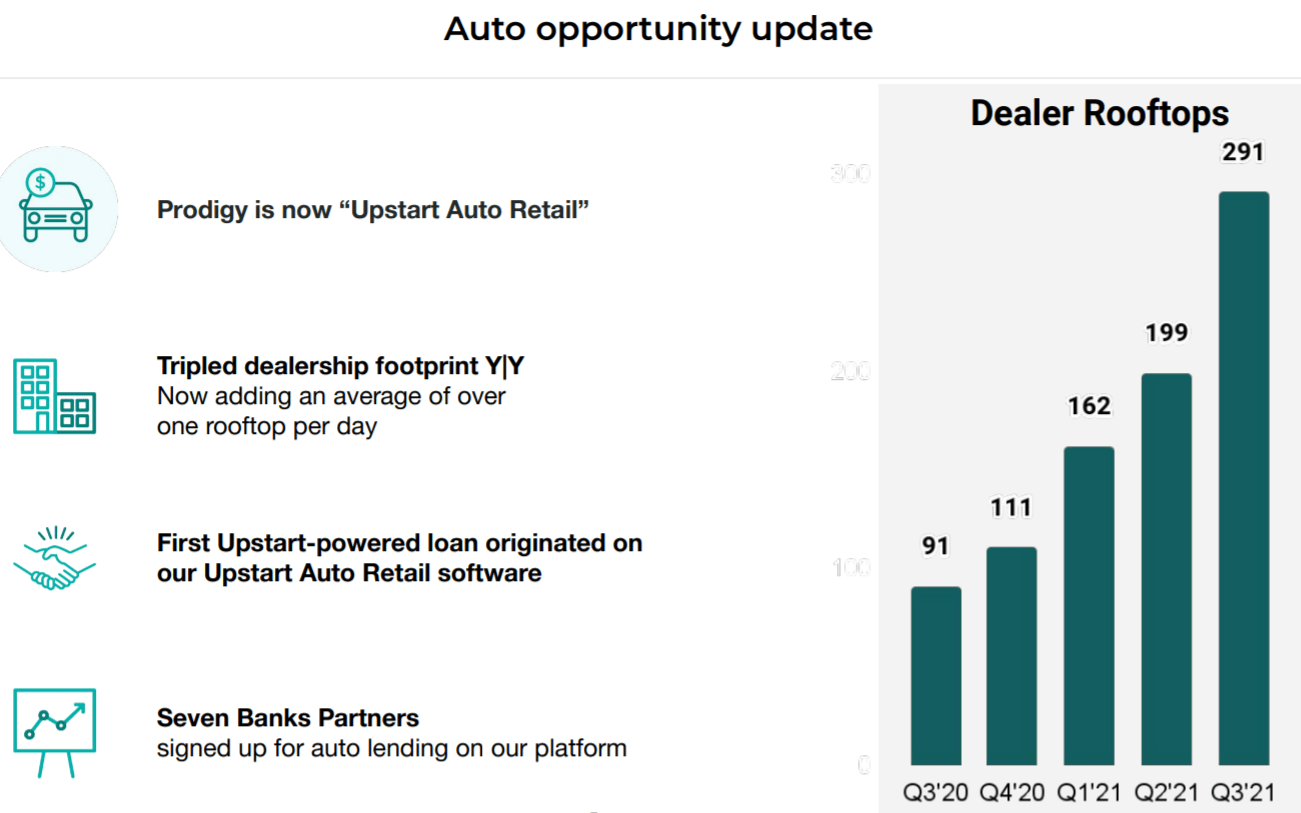

Upstart 5 Factors Driving The Stock Down And What The Future Holds Nasdaq Upst Seeking Alpha

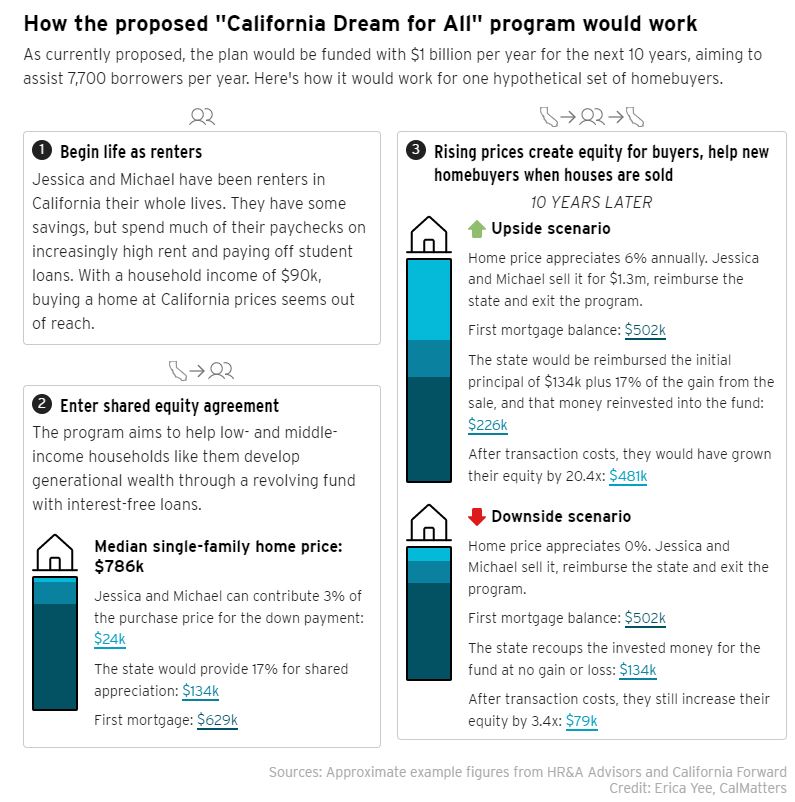

Thinking Of Buying Bubbleinfo Com

6 Reasons To Avoid Private Mortgage Insurance

Fixed Rate Vs Adjustable Rate Mortgage How To Decide Which One You Should Get Adjustable Rate Mortgage Mortgage Mortgage Protection Insurance

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

Wrong Hands By John Atkinson For January 29 2021 Gocomics Com Funny Words Teacher Humor Funny Cartoon Pictures

Mortgage Loan Trading Platforms How To Choose For Secondary Market